Dec. 13, 2019 - This was a busy week for news with a Federal Reserve meeting, elections in the U.K. and a lot of developments in the trade war between the U.S. and China.

The Federal Reserve kept rates steady, which was expected. The "dot plot" of expected future interest rates also got more dovish. Chairman Jerome Powell, during his press conference said the central bank would need to see "significant, persistent" inflation before raising rates, which is a departure from traditional policy where inflation has generally been assumed to occur when unemployment gets low.

Election in the U.K. saw Conservative Prime Minister Boris Johnson take a large majority in Parliament, which will allow Johnson to pass whatever Brexit deal he can negotiate with the E.U. It likely assures that the process will start on Jan. 31. Johnson had been expected to win, but polls leading up to Thursday's vote had suggested Johnson's lead was narrowing. In the end, the outcome was basically what had been expected, but Johnson's margin of victory was significantly higher.

Finally, the week wrapped up with what seem like positive developments on the trade front. News that the U.S. and China had reportedly agreed to a long-awaited "phase one" deal started to leak out earlier in the week as traders started to get nervous about a new round of tariffs that had been set to go into effect on Dec. 15.

Word started to come out Thursday that there was a deal, with the U.S. and China confirming... something Friday morning. It seems as though the U.S. has agreed to not impose new tariffs on Dec. 15, and that some tariffs currently at 15% will be cut to 7.5%. China's part is less clear. It seems that the country will agree to purchase more agricultural goods, with some reports saying purchases could reach as high as $50 billion per year. That's a significant increase from the roughly $24 billion China was buying before the trade war began. U.S. Trade Representative Robert Lighthizer said the makeup of those purchases was classified.

The deal will reportedly be signed in January, which talks about a "phase two" deal set to begin immediately. There is enough uncertainty about the contents, signing and effective dates of the deal that it is hard for the market to get too excited about it. Remember, Phase One was initially announced by President Trump on Oct. 11.

While it does seem like something more significant has actually been agreed to this time, the market seems to be taking a more cautious approach.

Indices

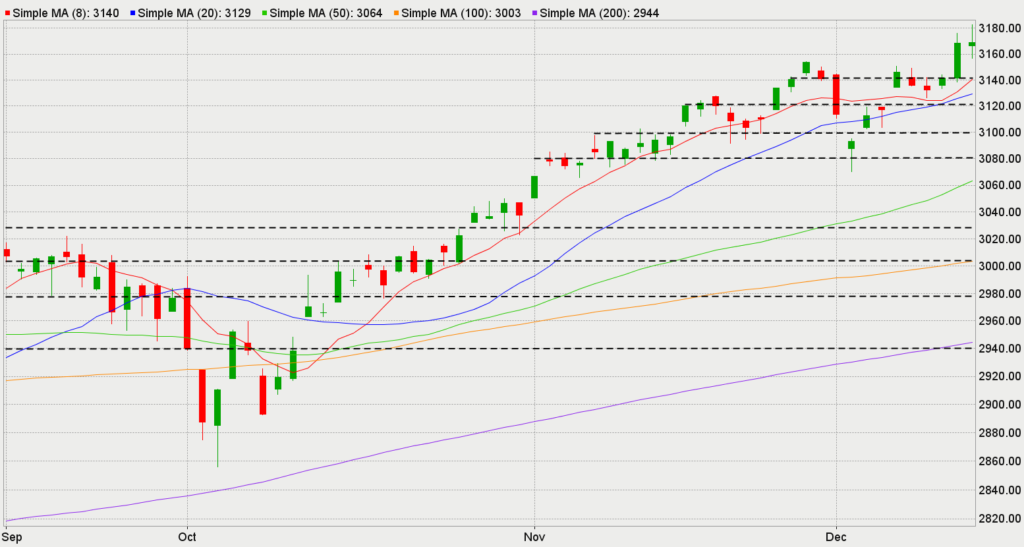

On the week, the S&P 500 gained 0.73%, the NASDAQ added 0.91%, and the Dow Jones Industrial Average rose 0.43%.S&P 500

Six Months