There has been near-constant speculation about the shape of the economic recovery since the Spring when measures to contain the coronavirus started to take effect.

Most investors have heard letters used to describe the shape of economic recoveries. V, U, L and even W-shaped recoveries have been identified in the past and suggested as the shape this time around.

A V-shaped recovery was the hope of most people, and the expectation of many. And with the stock market back at record highs, it may seem at first blush like that's what we're getting. However, if you look past the numbers for the major indices you get a different picture of what's happening, and a different letter for the stock market.

That letter is K. We're seeing a split in how companies and people are experiencing the recovery. Some companies are doing quite well, while other are struggling mightily. On an individual level, workers who can work from home, which tend to be more white-collar professionals are doing well, while many other people have lost jobs or seen hours cut back.

The K Stock Market

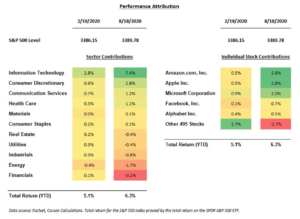

While the market appears to be fully recovered, it is the biggest biggest companies hitting new highs and pulling the indices higher while, smaller companies are feeling the worst effects. Amazon (AMZN), Apple (AAPL), Microsoft (MSFT), Facebook (FB), and Google (GOOG) have contributed to the S&P 500 being up 8.9% since February 19. During that same time, the other 495 stocks have contributed negative 2.7% to the S&P 500. Thus, the S&P 500 is up 6.2% since February 19 even though the bottom 495 stocks are down 2.7%. Let that sink in.

The market is being dragged along by the biggest stocks as evidenced by Invesco’s S&P 500 Equal Weight ETF (RSP) still down 6.8% from its high back in February while the market weighted SPDR S&P 500 ETF (SPY) is up more than 3.8% during the same period. Being down roughly 7% may not sound like much after the massive crash that happened just six months ago, however, many investors would be happy with a seven percent gain in a full year, so losing that amount in half of a year is a big hit.

Yes it's good that the biggest companies are doing well in the wake of this virus as they are some of the biggest providers of jobs and many services. But they only tell a small fraction of the overall story of what is going on in our economy right now. Many small businesses and even huge companies that just aren't in the top 0.01% are hurting right now. This recovery so far has told a very similar story when you move from the stock market to the economy and the people.

The K Economy

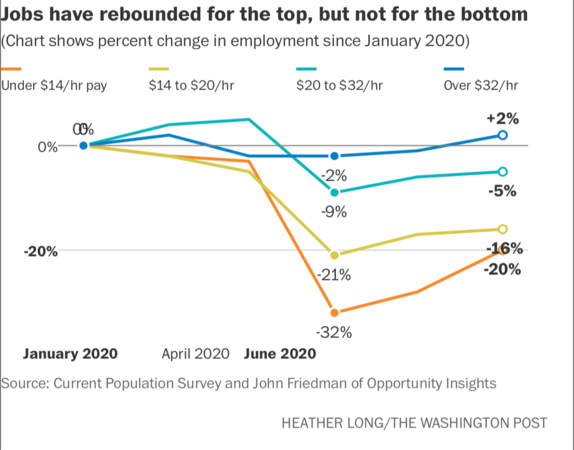

The K-shaped recovery is happening with the economy and jobs as well. Employment data is showing a similar pattern to the stock market. with unemployment rates showing a similar pattern. Individuals making more than $32 per hour have seen a 2% increase in employment rates since the new year while those making less than $14 per hour have seen a 20% decrease during that same time. Those making between $14 and $32 an hour have seen job losses between 6% and 16%. It is becoming clear that COVID-19 has made problems of income inequality worse.

Much of this is due to higher-income jobs being more adaptable to remote work. Those working at tech companies and certain other fields are able to easily transition to working from home. Even before the pandemic, many people were transitioning to working from home and but this leaves behind millions of service-industry workers who don't have that option. Many retailers and restaurants were forced to close amid the pandemic. Those businesses make up a large portion of the job market, and those workers still have bills to pay. Unemployment benefits and stimulus checks have helped fill some of this gap, but those payments have stopped going out now and are not a long-term substitute for a paycheck.

The Stocks to Invest In

With the stock market basically going two different directions right now, investors want to allocate their assets to the stocks going up. There is potential here to speculate on which stocks will fall to take advantage of both sides of the “K”. Clearly so far the biggest stocks are performing the best. Amazon, Apple, and Microsoft have all performed amazingly well since the crash and show no signs of slowing down soon. Facebook and Google have also done well and are also great choices. It should come as no surprise to investors that these stocks are almost all tech stocks, even Amazon, which is technically a retailer, is in many ways a tech company.

Certain big-box retailers like Walmart (WMT), Costco (COST) and Target (TGT) are also doing well, as are the home-improvement retailers like Lowe's (LOW) and Home Depot (HD).

While big tech companies are pulling the rest of the market with them, travel, real estate, and financial services stocks have been doing their best to keep it down. These sectors are fundamentally hurt the most by social distancing and a slowdown in the economy. In order for financial stocks to recover, there will need to be an increase in economic activity and confidence that people and small businesses can repay loans. Real estate, particularly commercial real estate, is going to continue to struggle until there is confidence that retailers and other businesses will be able to stay afloat and keep making rent.

Even though these sectors may not be in the best place right now, investors absolutely can profit from these situations with low stock prices that will almost certainly go up in the future. It may be hard to know when exactly American Airlines (AAL) or JP Morgan (JPM) will recover, but buying now while the price is low may be a great long-term move.

Wrapping Up

The K shaped recovery has become a very unique phenomenon brought about by the pandemic but is a much more accurate description of what is going on then the traditional V,U, and L-shapes commonly referred to. It is extremely unfortunate that the smaller companies and lower classes are being unproportionally hurt by this pandemic but sadly it is not a deviation from the norm. However, investors can focus on how to make the most of their situation by investing in the big guys for now while making longer term investments into undervalued stocks that are almost assuredly going to recover and become as strong as ever.