Coronavirus, which was declared a pandemic by the World Health Organization on March 11, 2020, has made a serious impact on the global economy. The virus led to a bear market in stocks as the S&P 500 fell 35.40 percent from its high on February 19, 2020 to a 52-week low on March 23, 2020.

Investors have experienced serious losses across their portfolios as almost all sectors of the market have fallen since the virus caused a number of countries to essentially close large sections of their economies. In this now bearish market, portfolio managers have begun to transfer assets from hurting sectors of the economy to superior performers.

Managers still have their portfolios balanced among many sectors for diversification purposes, but are now reallocating their assets during this change in the market cycle.

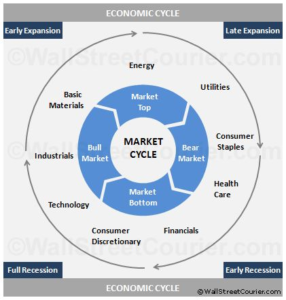

Sector rotation is a commonly used investing strategy that focuses on changes in the market cycle. There are three main Super Sectors of the economy according to Morningstar: Cyclical, Defensive, and Sensitive stocks. In a bullish or neutral market, portfolio managers allocate most of their assets in cyclical stocks. Conversely, in a bearish market individuals will begin to reallocate their assets into the defensive sector. This rebalancing of a portfolio is the basis of sector rotation.

Portfolios are rebalanced by liquidating assets from one sector in order to reinvest into another during a change in the market cycle. Investors will still retain assets in cyclical and sensitive stocks in order to protect their entire portfolio from experiencing a major loss due to one sector performing poorly. Thus, potential losses in a specific sector will not heavily impact an entire collection of assets as long as other sectors offset the losses by performing well or simply holding their value.

Sector rotation can be used when certain sectors or industries are growing rapidly in the economy. For example, if technology stocks are currently trending upward, investors can sell assets they have in lower performing sectors to purchase technology stocks to experience higher growth in their portfolio. Generally this investment strategy is used when transitioning to different parts of the market cycle. Currently, investors have a great opportunity to capitalize on major changes in the market caused by the coronavirus pandemic.

When transitioning into a slowing economy, the common practice is to sell assets from the cyclical sectors: basic materials, consumer cyclical, financial services, and real estate. That capital is then allocated to the defensive sectors: health care, utilities, and consumer defensive.

Defensive stocks should hold their value in a bear market more than cyclical ones due to consumer behavior. People will typically cut unnecessary costs, such as purchasing new vehicles and eating at restaurants, out of their budgets, but will continue to pay necessary expenses such as utility bills unless in dire situations. Thus, when the stock market is trending downward, defensive stocks are more likely to hold their value.

When coming out of a bear market or economic recession, investors hope to time the market correctly when reallocating their assets into sensitive sectors such as technology and industrials. Sensitive stocks tend to realize the highest growth during the early part of a bull market. Cyclical securities will also usually see a bump in growth in this phase and are expected to continue to perform well while in a bullish market.

While these general guidelines can be extremely useful, the coronavirus has affected the economy in a number of unique ways. Obviously, retail stores and companies reliant on physical locations have been impacted the hardest by this disease. With people staying at home, companies such as Zoom (ZM), Electronic Arts (EA), and Netflix (NFLX) have been performing well due to changes in demand. Meanwhile, travel industries such as airlines and cruises have taken a beating due to the combination of new government regulations and changes in consumer behavior.

Once the worst effects of this virus have passed, the question is going to be: which sectors of the market will have the strongest recovery? A natural assumption would be for many of the sectors that were hit hard to recover to pre-virus levels, but an event like this may cause long-lasting changes in behavior. The reliance on virtual meetings for businesses may lead to companies realizing there is much less need for business travel when it can simply be done online. Many companies might see no noticeable drop in productivity with employees working remotely which would then have damning effects on the travel industry. Cruises may never recover if people stay hesitant to gather in such large groups for a prolonged period of time.

These potential changes in the economy would hurt oil and automobile companies, while likely leading to increased growth at tech companies. The long-term effects of coronavirus will not be known until much farther down the line. Many sectors will be impacted for better or worse as the pandemic will change behavior across the economy.