Stock Update

“Narrow breadth”? No problem. Goldman Sachs bets big on another S&P 500 rally

Despite overvaluation risks and narrow market breadth, Goldman sees rate cuts and the Magnificent 7 driving the index to 6,900 within a year

Read more about “Narrow breadth”? No problem. Goldman Sachs bets big on another S&P 500 rally

Uber doubles revenue with flat headcount, but at what cost to drivers?

Uber’s revenues are soaring past $50 billion and its stock is up 60% in 2025, yet critics say the company’s gig workers are footing the bill as earnings lag under new pricing models

Read more about Uber doubles revenue with flat headcount, but at what cost to drivers?

SoundHound stock breaks out, but Taco Bell’s voice AI warning may be the canary in the coal mine

Taco Bell’s second thoughts on drive-thru AI highlight cracks in the fast-food adoption story for SOUN stock

Read more about SoundHound stock breaks out, but Taco Bell’s voice AI warning may be the canary in the coal mine

Federal investigation into UnitedHealth is much worse than previously thought

As it turns out, the DOJ criminal division’s scrutiny into the company’s corporate practices is not just limited to its handling of the Medicare program

Read more about Federal investigation into UnitedHealth is much worse than previously thought

Needham analyst: Rivian's affordable SUV could be a game-changer for RIVN stock

There's “strong RIVN brand awareness, limited negative perception and encouraging purchase intent, positioning RIVN favorably to capture share as the R2 enters the mid-size SUV segment.”

Read more about Needham analyst: Rivian's affordable SUV could be a game-changer for RIVN stock

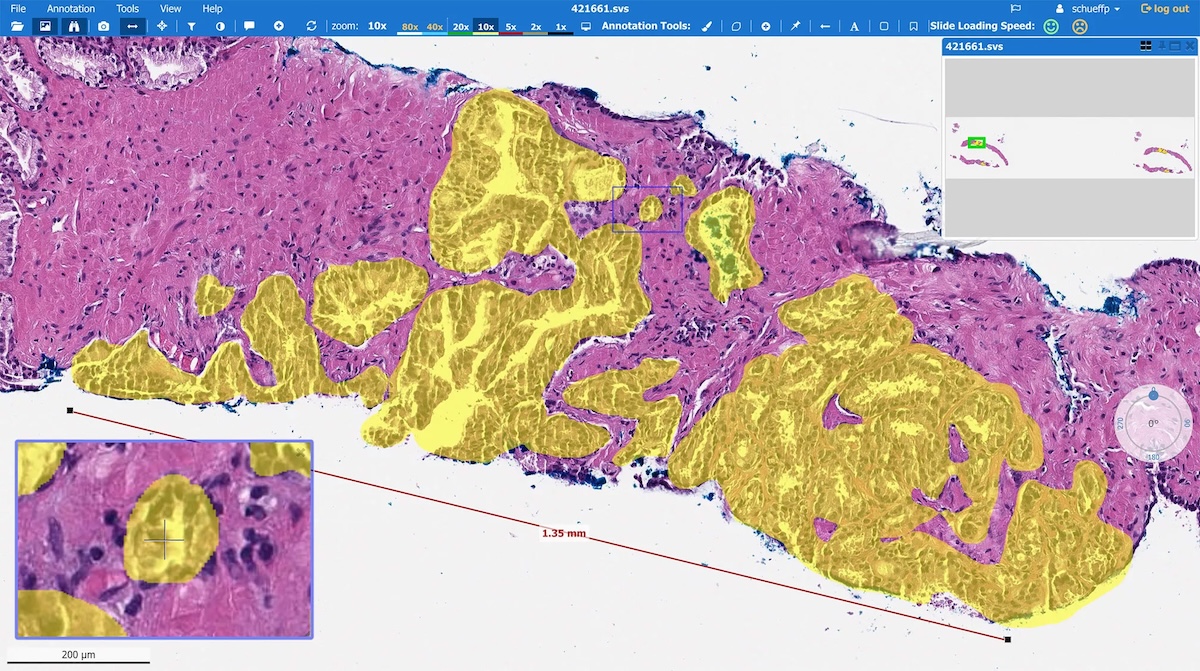

Smart exit or AI fire sale? Tempus AI buys Paige for $81M after raising $241M

Paige was founded in 2017 and deployed the first FDA-approved AI application in pathology, which allows researchers and pathologists to better detect cancer.

Read more about Smart exit or AI fire sale? Tempus AI buys Paige for $81M after raising $241M

GE Vernova’s (GEV) turbines, not chips, could be the real AI infrastructure play

GE Vernova (GEV) stock has quietly outpaced the AI rally with gas turbines and nuclear power, but questions about valuation risk are growing louder

Read more about GE Vernova’s (GEV) turbines, not chips, could be the real AI infrastructure play

Jensen Huang’s AI prediction is more bullish for NBIS stock than Nvidia

As Nvidia signals a $4 trillion AI infrastructure wave, Nebius is emerging as the stealth cloud player riding the inference boom — with growth that’s already eclipsing the chip giant.

Read more about Jensen Huang’s AI prediction is more bullish for NBIS stock than Nvidia

Rare buying opportunity in oil and energy stocks? Bearish oil bets hit 25-year high

Bearish bets on U.S. crude are at a historic high, signaling potentially overblown expectations of a steep drop in energy prices. But not everyone is buying the doom narrative.

Read more about Rare buying opportunity in oil and energy stocks? Bearish oil bets hit 25-year high

‘This isn’t capitalism. It’s something else entirely’ — Intel’s deal comes at shareholders’ expense, analysts warn

Trump's plan to take a direct equity stake in Intel (INTC) may sound like a powerful vote of confidence, but it carries big dilution risks for shareholders

Read more about ‘This isn’t capitalism. It’s something else entirely’ — Intel’s deal comes at shareholders’ expense, analysts warn

Here's why this earnings season looks too good to be true

Analysts slashed forecasts so much this spring that companies had an easy time clearing them, raising the risk that today’s “surprise strength” could be tomorrow’s disappointment.

Read more about Here's why this earnings season looks too good to be true

DJT stock just pulled a MicroStrategy move, but with a token you’ve barely heard of

Trump Media unveiled a massive new treasury strategy that's moved both its stock and the whole digital asset market

Read more about DJT stock just pulled a MicroStrategy move, but with a token you’ve barely heard of

'America’s drone future' — Unusual Machines and Ondas Double Down on AI-powered drones

Unusual Machines (UMAC) and Ondas Holdings (ONDS) are joining forces with Safe Pro Group (SPAI) to push battlefield-tested AI vision tech into U.S. and NATO drone fleets

Read more about 'America’s drone future' — Unusual Machines and Ondas Double Down on AI-powered drones

IREN stocks skyrockets as it doubles its Nvidia GPUs and secures new funding

The company said that it had procured an additional 4.2K NVIDIA Blackwell B200 GPUs for approximately $193 million, which doubles its total GPU fleet to about 8.5K NVIDIA GPUs

Read more about IREN stocks skyrockets as it doubles its Nvidia GPUs and secures new funding

Orsted stock plummets after Trump administration halts offshore wind project that is 80% finished

The Bureau of Ocean Energy Management (BOEM) sent a letter on Friday to Revolution Wind LLC with a work-stoppage order

Read more about Orsted stock plummets after Trump administration halts offshore wind project that is 80% finished

Here's how EV tax credit elimination can boost Ford (F) stock

EV makers are racing to move inventory before the credit disappears at the end of September, pulling forward demand that was originally expected to stretch into the next decade.

Read more about Here's how EV tax credit elimination can boost Ford (F) stock

Economist warns that Fed cuts could deepen America’s housing crisis

"The real solution is letting house prices fall so buyers don’t need to borrow as much to buy them. Ironically, Fed rate cuts will push mortgage rates even higher,” Peter Schiff said.

Read more about Economist warns that Fed cuts could deepen America’s housing crisis

Analysts see moonshot potential in Intuitive Machines (LUNR) despite brutal setbacks

With shares down more than 50% this year, analysts argue the space-tech firm’s strengthened balance sheet, $250 million backlog, and fresh contracts could bring a turnaround

Read more about Analysts see moonshot potential in Intuitive Machines (LUNR) despite brutal setbacks