Jul 2, 2020 - Stocks posted gains for this holiday-shortened week.

The S&P 500 remains in a range defined by June 11. That was the last big drop for stocks after the June 8 recent highs, and seems to have been something of a turning point in the rally thus far.

The action in the market this week seemed almost like a typical summer trading day, volumes weren't particularly high and the market sort of drifted upward with no real catalyst.

The biggest news this week came this morning with dueling jobs reports. The usual Thursday look at new and continuing claims for unemployment and the monthly Employment Situation Report.

The weekly report, which is from the week ended June 17, showed 1.43 million people filing first-time claims for unemployment, which represents a drop of about 55,000 from the prior week. Any reduction in that number is a positive, but it seems clear that the rate of reduction has slowed drastically in recent weeks.

The monthly report, which it should be noted, was based on data collected the week of June 12, showed that 4.8 million jobs were created in June, pushing the unemployment rate down to 11.1%. Look past the headlines though, and things start to get interesting.

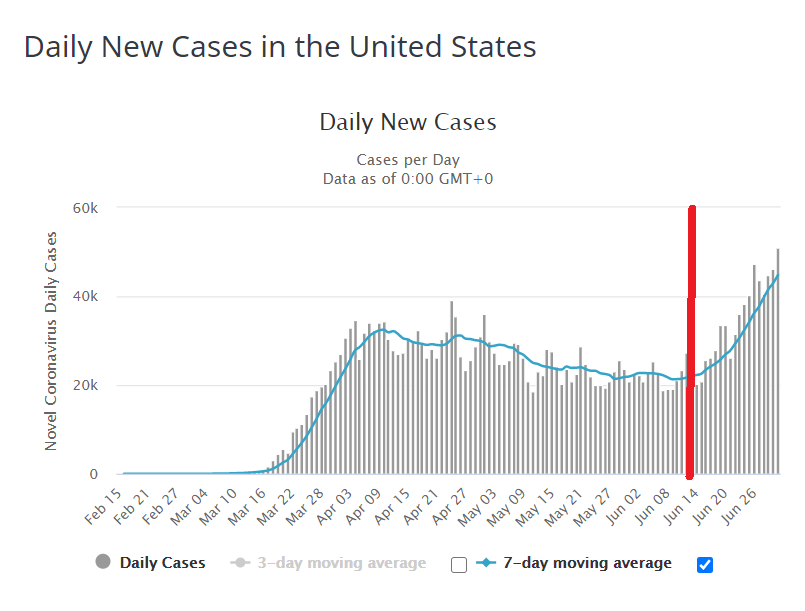

First, it seems very relevant to look back at that June 12 survey date. Economist Betsy Stevenson tweeted this chart showing that we were in a very different place in terms of dealing with the pandemic on June 12.

Second, the Bureau of Labor Statistics' writeup of the household survey data yielded this passage:

"The number of unemployed persons who were on temporary layoff decreased by 4.8 million in June to 10.6 million, following a decline of 2.7 million in May. The number of permanent job losers continued to rise, increasing by 588,000 to 2.9 million in June. "

It is good, and should be expected that as more of the economy reopens, the people who were temporarily laid off are returning to work, but the steady increase in the number of permanent job losses is worrisome.

Reading further into the date from the establishment survey, we see that the Leisure and Hospitality industry added 2.1 million jobs, or about 40% of the total jobs added. Those are likely the first jobs to have been cut this past week as parts of the country tightened up their restrictions in an effort to slow the rapid spread of the coronavirus.

Neither of the employment reports released this week capture changes to the economy this week, when an explosion of new infections lead a lot of states to slow their plans to reopen, and while restrictions were tightened in some places.

It turns out that consumers are capable of making decisions without being prompted by the government. A working paper from the National Bureau of Economic Research published this week found that shutdown orders accounted for about 7 percentage points of the 60 percentage point decline in consumer traffic earlier this year. The paper found that consumer behavior shifted before orders were put in place, and was highly correlated with the number of deaths in a given county.

This paper echoes findings from JP Morgan Chase that showed consumer behavior was pretty highly correlated across both states with strict lock-down orders and those that re-opened relatively early or even had no restrictions at all.

This seemed to be happening already. Turning again to JP Morgan's credit card data, we can see that total spending started to roll over before various governments started to act this week.

So far, the market hasn't had the negative reaction it had to the first wave of coronavirus, but with the daily count of new cases at record highs and consumer spending seemingly starting to roll over, the market could react like it earlier in the year.

Of course, the early-March conditions were before Congress and the Federal Reserve acted to support the economy, so it's possible the market could keep cruising along for a while. Late July will be an important period under that scenario, as that is when the expanded unemployment benefits that many have credited for the relative resilience of the economy are set to expire.

All told this week, the S&P 500 added 4.02%, while the Nasdaq gained 4.62% and the Dow Jones rose 3.25%.