Stock Update

'Diluted to hell’—Wolfspeed’s stock surges as it exits bankruptcy, but shareholders are seething

When Wolfspeed (WOLF) filed for Chapter 11 bankruptcy protection this summer, its shares skyrocketed 530% in the five days after announcing its reorganization.

Read more about 'Diluted to hell’—Wolfspeed’s stock surges as it exits bankruptcy, but shareholders are seething

SOXL: Retail traders rush for the exit after 120% semiconductor boom

Leveraged bets on U.S. semiconductor stocks have surged since the “Liberation Day” market sell-off in April, prompting retail investors to lock in gains at one of the fastest paces since the pandemic.

Read more about SOXL: Retail traders rush for the exit after 120% semiconductor boom

Oklo secures second pilot project with U.S. Energy Department, but still gets downgraded

Oklo became the only publicly traded company named to a new Energy Department pilot program

Read more about Oklo secures second pilot project with U.S. Energy Department, but still gets downgraded

SEC suspends QMMM Holdings (QMMM) over ‘potential manipulation’ of its securities

Regulators flag aggressive trading volumes of QMMM

Read more about SEC suspends QMMM Holdings (QMMM) over ‘potential manipulation’ of its securities

Unusual Machines lands $12.8M defense order for its drone components

Unusual Machines (UMAC) said on Tuesday it has received a $12.8 million order

Read more about Unusual Machines lands $12.8M defense order for its drone components

Coinbase goes to war with Wall Street over stablecoin rewards

Coinbase (COIN) launched a marketing campaign push on Monday, calling on U.S. senators to reject Wall Street’s aim to ban rewards or yields on stablecoins offered by crypto companies

Read more about Coinbase goes to war with Wall Street over stablecoin rewards

Here's why Tempus AI is down today

Ark Invest founder Cathie Wood has been one of the biggest champions of Tempus AI (TEM). Not anymore

Read more about Here's why Tempus AI is down today

Here's why cannabis stocks could be the next AI trade

Of all the sectors that investors could see reaping the benefits of a “Trump bump,” the cannabis industry would probably not be the first that comes to mind.

Read more about Here's why cannabis stocks could be the next AI trade

Science lost to politics: How Kenvue fumbled the Tylenol-autism connection

Kenvue’s factual but reactive response to Trump’s claims linking Tylenol to autism failed to calm fears, sparking a stock rout.

Read more about Science lost to politics: How Kenvue fumbled the Tylenol-autism connection

Boeing shares rise as FAA eases restrictions on controversial 737 MAX planes

Boeing (BA) stock is climbing as the FAA eases restrictions on 737 MAX production, signaling renewed confidence in the aircraft maker’s safety and manufacturing practices.

Read more about Boeing shares rise as FAA eases restrictions on controversial 737 MAX planes

Oklo shares tumble as Goldman points to ‘financial risks’ for nuclear startup

Oklo (OKLO) stock tumbled after Goldman Sachs flagged financial risks and lack of customer deals despite strong government support and soaring year-to-date gains.

Read more about Oklo shares tumble as Goldman points to ‘financial risks’ for nuclear startup

How 13 years of buybacks made Google stock unstoppable

After lagging early in 2025, Alphabet (GOOGL) stock has surged nearly 50% since June as massive buybacks, AI gains, and court wins spark renewed investor confidence.

Read more about How 13 years of buybacks made Google stock unstoppable

Are Google's recent deals pointing to AI-Bitcoin pivot?

Google will backstop $1.4 billion of Fluidstack’s lease obligations to support project-related debt financing, furthering its push into the AI infrastructure market.

Read more about Are Google's recent deals pointing to AI-Bitcoin pivot?

AI fatigue? Wall Street shrugs off CoreWeave OpenAI deal

The total value of the deal between the two AI giants is now worth roughly $22.4 billion.

Read more about AI fatigue? Wall Street shrugs off CoreWeave OpenAI deal

How Apple could use political ties at home to push its agenda overseas

While a number of tech companies have made efforts to appease Trump, it's Apple (AAPL) CEO Tim Cook who appears to most closely follow Musk’s blueprint

Read more about How Apple could use political ties at home to push its agenda overseas

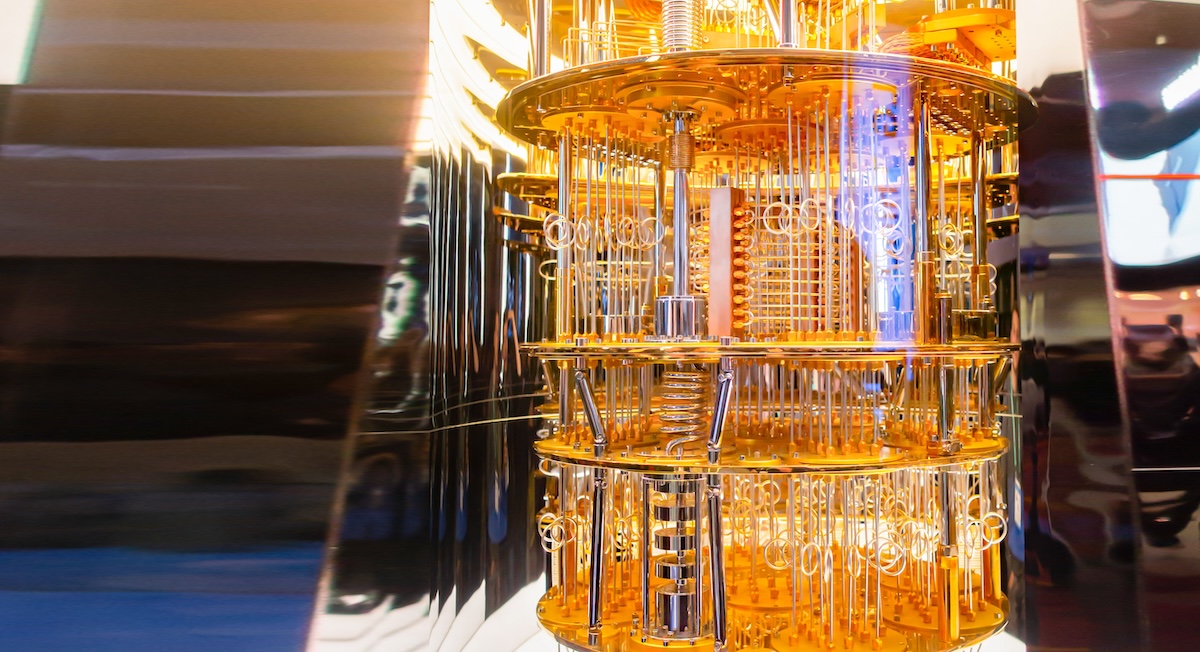

IonQ made ‘significant’ breakthrough in collaboration with U.S. Air Force

IonQ (IONQ) said this week that it has made a “significant technological advancement” that could accelerate the progress toward building a quantum internet.

Read more about IonQ made ‘significant’ breakthrough in collaboration with U.S. Air Force

Bitcoin miner IREN doubles down on AI cloud services with latest Nvidia and AMD GPU purchases

Wall Street is bullish on IREN stock's AI pivot

Read more about Bitcoin miner IREN doubles down on AI cloud services with latest Nvidia and AMD GPU purchases

Micron (MU) stock fails to impress Wall Street — here's why

Micron (MU) stock might be a victim of its own success

Read more about Micron (MU) stock fails to impress Wall Street — here's why