Stock Update

Costco (COST) stock historic run hits a tall, thick wall — here's why

Costco (COST) has pulled off a historic run, one that has analysts asking: how much higher can it really go?

Read more about Costco (COST) stock historic run hits a tall, thick wall — here's why

Pfizer’s CEO plays Trump’s game but Wall Street couldn't care less

If there’s one sure way to stay in President Trump’s good graces, it’s a healthy dose of flattery. And Pfizer knows that...

Read more about Pfizer’s CEO plays Trump’s game but Wall Street couldn't care less

Here's the real (weird) reason Rocket Lab (RKLB) stock crashed

A short report from Bleeker Street Research suddenly resurfaced on social media. The odd part is that the report was published back in February.

Read more about Here's the real (weird) reason Rocket Lab (RKLB) stock crashed

Apple is the Nokia of the AI age, analysts warn

Things are going from bad to worse for Apple (AAPL) in the AI arms race.

Read more about Apple is the Nokia of the AI age, analysts warn

IBM: Enterprise AI juggernaut or just a ’90s nostalgia trade?

IBM (IBM) may not be an AI rocket ship like Nvidia (NVDA) or OpenAI, but it has carved out a steady, enterprise-focused niche in artificial intelligence.

Read more about IBM: Enterprise AI juggernaut or just a ’90s nostalgia trade?

Dell stock crowned Wall Street’s new AI juggernaut

Analysts are racing to slap higher price targets on the Dell stock as it cements itself as one of the most powerful players in the AI server market.

Read more about Dell stock crowned Wall Street’s new AI juggernaut

Trump’s FTC chief to Big Tech: Don’t bow to EU censorship rules

Federal Trade Commission Chairman Andrew Ferguson fired off a letter to 13 of America’s biggest tech companies, including Meta (META), Apple (AAPL), Alphabet (GOOG), Amazon (AMZN), and Microsoft (MSFT)

Read more about Trump’s FTC chief to Big Tech: Don’t bow to EU censorship rules

SoundHound's AI voice assistant hits Jeeps, analysts call it $35B revolution

SoundHound (SOUN) just notched another milestone in its partnership with Stellantis (STLA), announcing that its generative AI-powered voice assistant is now live in select Jeep vehicles

Read more about SoundHound's AI voice assistant hits Jeeps, analysts call it $35B revolution

Broadcom’s $1.4 trillion secret weapon in the AI arms race

Broadcom (AVGO) has long been considered a backbone of the AI boom, but analysts argue its importance has been “underappreciated” compared with the spotlight on Nvidia (NVDA).

Read more about Broadcom’s $1.4 trillion secret weapon in the AI arms race

Tesla's Europe nightmare has begun

Tesla (TSLA) sales continue to tumble in Europe, one of the world’s most EV-friendly regions with strict mandates and environmentally conscious consumers.

Read more about Tesla's Europe nightmare has begun

Cava's 'next Chipotle' dreams face a harsh reality check

Fast-casual chain Cava (CAVA) rose to prominence on hype that it could become the “Mediterranean Chipotle.” Those analogies have faded since

Read more about Cava's 'next Chipotle' dreams face a harsh reality check

D-Wave (QBTS) crowned quantum pioneer, but can it ever make money?

As one of the few pure-play quantum small caps, Canadian startup D-Wave (QBTS) has become a go-to speculative bet on the sector

Read more about D-Wave (QBTS) crowned quantum pioneer, but can it ever make money?

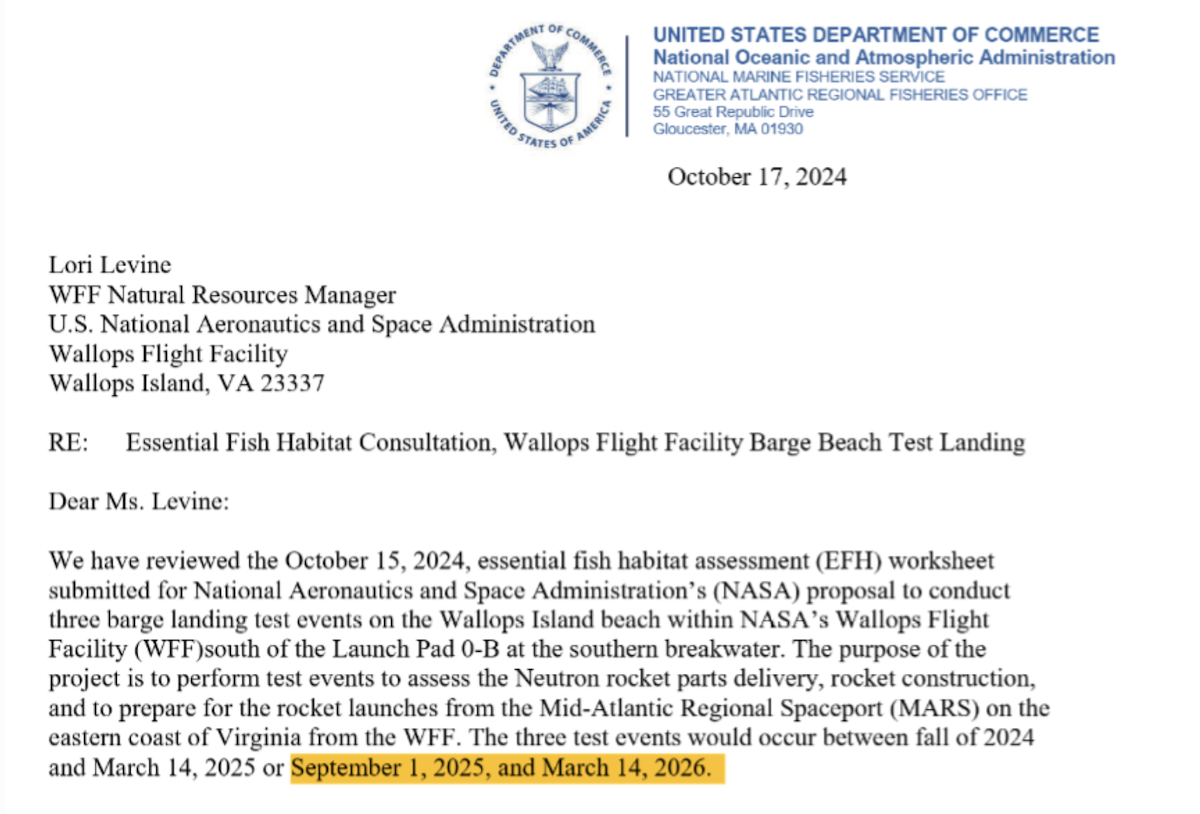

Wall Street's top analyst calls CrowdStrike ‘gold standard’ of cybersecurity

Wedbush analyst Dan Ives — one of the Street’s most influential tech voices — recently added CrowdStrike to his “IVES AI Revolution 30” list

Read more about Wall Street's top analyst calls CrowdStrike ‘gold standard’ of cybersecurity

Serve Robotics wins bullish call from one of Wall Street’s most influential analysts

Autonomous delivery startup Serve Robotics (SERV), which positions itself as “the future of self-driving delivery,” is starting to get Wall Street’s attention.

Read more about Serve Robotics wins bullish call from one of Wall Street’s most influential analysts

Wall Street bets on robot takeover with Serve Robotics (SERV) at the forefront

Autonomous delivery startup Serve Robotics (SERV), which brands itself as “the future of self-driving delivery,” may see that future arrive sooner than expected.

Read more about Wall Street bets on robot takeover with Serve Robotics (SERV) at the forefront

IBM and AMD plot quantum supercomputer that could kill Nvidia’s AI monopoly

IBM (IBM) announced this week that it is teaming up with AMD (AMD) to develop next-generation computing architectures

Read more about IBM and AMD plot quantum supercomputer that could kill Nvidia’s AI monopoly

“Narrow breadth”? No problem. Goldman Sachs bets big on another S&P 500 rally

Despite overvaluation risks and narrow market breadth, Goldman sees rate cuts and the Magnificent 7 driving the index to 6,900 within a year

Read more about “Narrow breadth”? No problem. Goldman Sachs bets big on another S&P 500 rally

Uber doubles revenue with flat headcount, but at what cost to drivers?

Uber’s revenues are soaring past $50 billion and its stock is up 60% in 2025, yet critics say the company’s gig workers are footing the bill as earnings lag under new pricing models

Read more about Uber doubles revenue with flat headcount, but at what cost to drivers?