Stock Update

Archer Aviation (ACHR) isn’t building flying taxis. It’s building battlefield drones

As eVTOL shifts from Uber dreams to defense logistics, ACHR stock is emerging as a tactical mobility frontrunner

Read more about Archer Aviation (ACHR) isn’t building flying taxis. It’s building battlefield drones

UMAC, RCAT stocks go parabolic as Trump declares drone manufacturing national priority

Trump’s orders aim to crush China’s drone monopoly and investors are betting U.S. players like UMAC and RCAT will win big

Read more about UMAC, RCAT stocks go parabolic as Trump declares drone manufacturing national priority

“Fight AI with AI”—Palo Alto Networks (PANW) and Okta (OKTA) enters next-gen security war

Palo Alto Networks (PANW) and Okta (OKTA) are rewriting the cybersecurity playbook for the AI era.

Read more about “Fight AI with AI”—Palo Alto Networks (PANW) and Okta (OKTA) enters next-gen security war

MP Materials (MP) goes to war as Defense Department invests $400M to cut out China

With $400M in DoD funding, MP Materials (MP) is leading America’s charge to break China’s monopoly.

Read more about MP Materials (MP) goes to war as Defense Department invests $400M to cut out China

Uber (UBER) Is Alphabet’s secret weapon in robotaxi race

Waymo is on track to become a billion-dollar business in the near future, creating a potential tailwind for Uber’s stock.

Read more about Uber (UBER) Is Alphabet’s secret weapon in robotaxi race

HSBC calls Broadcom (AVGO) $400 stock due to AI supercycle

Broadcom’s (AVGO) massive AI revenue projections are based on just three hyperscaler customers. Imagine the upside if it doubles that number, according to HSBC.

Read more about HSBC calls Broadcom (AVGO) $400 stock due to AI supercycle

Palantir (PLTR) is the “next Oracle”, analysts say

Wedbush analyst Dan Ives and Strategy Asset Managers CEO Tom Hulick see the company as a major beneficiary of the AI boom.

Read more about Palantir (PLTR) is the “next Oracle”, analysts say

Intel (INTC) may kill its flagship chip after billion-dollar investment

The company is reportedly laying off another 4,000 employees, including engineers

Read more about Intel (INTC) may kill its flagship chip after billion-dollar investment

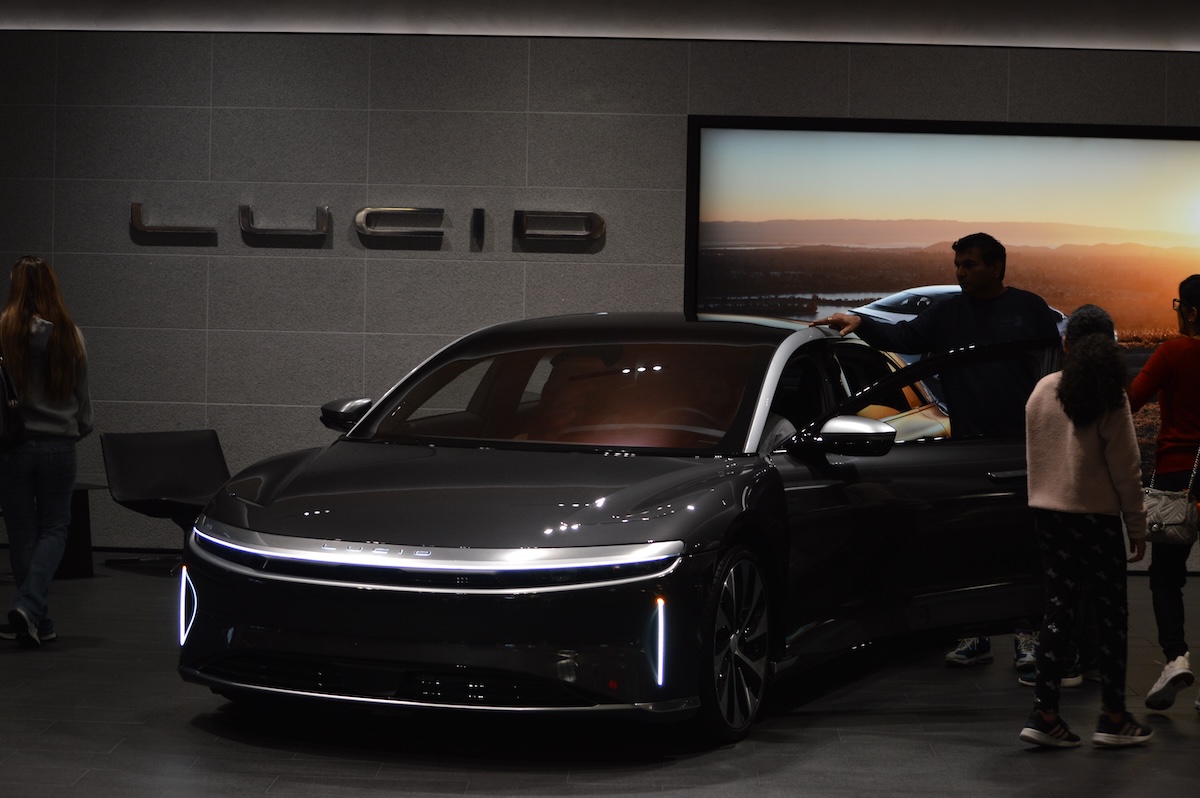

Lucid sets world record for longest drive on a single charge, but there's a catch

Lucid (LCID) interim CEO Marc Winterhoff said there's a “dramatic uptick” in former Tesla owners exploring the brand

Read more about Lucid sets world record for longest drive on a single charge, but there's a catch

GE Vernova could be on the cusp of building the first SMR in the U.S.

The Trump administration has turned the global race for AI dominance into a new “Manhattan project”

Read more about GE Vernova could be on the cusp of building the first SMR in the U.S.

Nvidia (NVDA) stock is now bigger than Germany (yes, the country)

As of Friday’s close, Nvidia’s market cap stood at just over $4 trillion, nearly $1 trillion higher than the Bloomberg Germany Exchange tracker

Read more about Nvidia (NVDA) stock is now bigger than Germany (yes, the country)

Here's reason Super Micro (SMCI) stock crashed despite analyst upgrades

That’s because a closer look at those upgrades shows they came with a warning

Read more about Here's reason Super Micro (SMCI) stock crashed despite analyst upgrades

Unprecedented short-selling tests Hims & Hers amid Novo Nordisk fallout

Even without the Novo Nordisk fallout, a HIMS stock correction may have been overdue

Read more about Unprecedented short-selling tests Hims & Hers amid Novo Nordisk fallout

Boeing (BA) stock scores $2.2B Space Force contract for next-gen satellites

Boeing’s comeback story just literally launched into orbit

Read more about Boeing (BA) stock scores $2.2B Space Force contract for next-gen satellites

Here's why Delta (DAL) earnings are a litmus test for airline stocks

Delta’s upbeat earnings set off a wave of buying across the entire airline sector

Read more about Here's why Delta (DAL) earnings are a litmus test for airline stocks

CVS Health (CVS) is quietly staging comeback after losing 900 stores and 60% of its value

After a massive retail shake-up between 2022 and 2024, CVS Health stock is coming back in full force.

Read more about CVS Health (CVS) is quietly staging comeback after losing 900 stores and 60% of its value

Hims & Hers (HIMS) turns Novo Nordisk’s patent lapse into its next big bet

Novo Nordisk’s lapse is Hims & Hers’ gain.

Read more about Hims & Hers (HIMS) turns Novo Nordisk’s patent lapse into its next big bet

Trump launches his own crypto ETF from inside the White House

Trump Media & Technology Group (DJT) just unveiled a new bitcoin-heavy ETF as President Trump blurs the line between business and the presidency.

Read more about Trump launches his own crypto ETF from inside the White House