Stock Update

How 13 years of buybacks made Google stock unstoppable

After lagging early in 2025, Alphabet (GOOGL) stock has surged nearly 50% since June as massive buybacks, AI gains, and court wins spark renewed investor confidence.

Read more about How 13 years of buybacks made Google stock unstoppable

Are Google's recent deals pointing to AI-Bitcoin pivot?

Google will backstop $1.4 billion of Fluidstack’s lease obligations to support project-related debt financing, furthering its push into the AI infrastructure market.

Read more about Are Google's recent deals pointing to AI-Bitcoin pivot?

AI fatigue? Wall Street shrugs off CoreWeave OpenAI deal

The total value of the deal between the two AI giants is now worth roughly $22.4 billion.

Read more about AI fatigue? Wall Street shrugs off CoreWeave OpenAI deal

How Apple could use political ties at home to push its agenda overseas

While a number of tech companies have made efforts to appease Trump, it's Apple (AAPL) CEO Tim Cook who appears to most closely follow Musk’s blueprint

Read more about How Apple could use political ties at home to push its agenda overseas

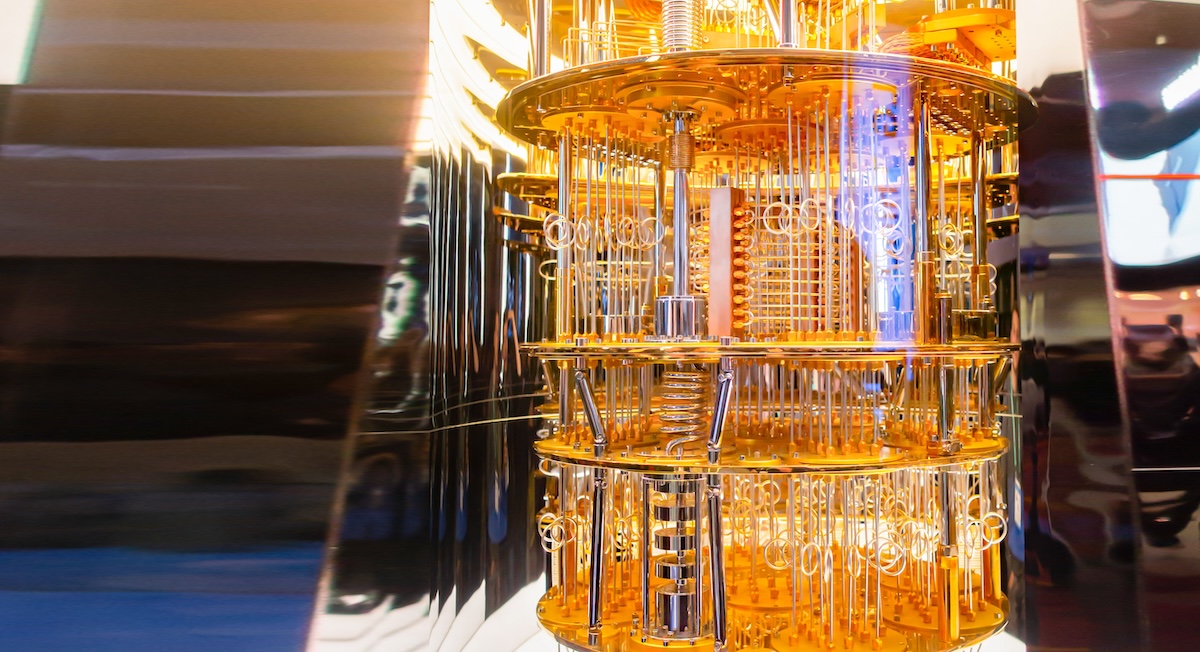

IonQ made ‘significant’ breakthrough in collaboration with U.S. Air Force

IonQ (IONQ) said this week that it has made a “significant technological advancement” that could accelerate the progress toward building a quantum internet.

Read more about IonQ made ‘significant’ breakthrough in collaboration with U.S. Air Force

Bitcoin miner IREN doubles down on AI cloud services with latest Nvidia and AMD GPU purchases

Wall Street is bullish on IREN stock's AI pivot

Read more about Bitcoin miner IREN doubles down on AI cloud services with latest Nvidia and AMD GPU purchases

Micron (MU) stock fails to impress Wall Street — here's why

Micron (MU) stock might be a victim of its own success

Read more about Micron (MU) stock fails to impress Wall Street — here's why

AMD’s “dead money” label looks like a $1 trillion opportunity, analysts say

Wall Street skeptics still view AMD in Nvidia’s shadow, but analysts argue its chiplet edge, Lisa Su’s turnaround, and bullish technical setup could power the stock to record highs

Read more about AMD’s “dead money” label looks like a $1 trillion opportunity, analysts say

“This is the biggest financial problem our society faces”: The dark side of Wall Street’s massive AI bet

Tech giants are pouring billions into data centers, but the surge in electricity costs is hitting consumers, driving inflation, and reshaping the investment landscape.

Read more about “This is the biggest financial problem our society faces”: The dark side of Wall Street’s massive AI bet

Palantir’s paradox? Recession-proof AI startup or overvalued surveillance giant?

Analysts hail Palantir’s execution in AI and government work, but with the stock trading at 105x forward sales, skeptics warn valuations are stretched to the limit.

Read more about Palantir’s paradox? Recession-proof AI startup or overvalued surveillance giant?

Wall Street joins Main Street in betting bull market isn’t done yet, but there’s a catch

Institutional investors ramp up stock exposure as Fed rate cuts revive “easy money”, but doubts over political pressure on the central bank could spoil the rally.

Read more about Wall Street joins Main Street in betting bull market isn’t done yet, but there’s a catch

CleanSpark lands $100M bitcoin-backed credit from Coinbase Prime

Bitcoin mining company CleanSpark (CLSK) said on Monday that it has secured a $100 million credit facility with Coinbase Prime, the crypto company’s institutional prime brokerage unit.

Read more about CleanSpark lands $100M bitcoin-backed credit from Coinbase Prime

Federal judge overturns Trump’s halt on Orsted’s offshore wind project

Danish renewable energy company Orsted (ORSTED) plunged over 16% last month when the U.S. Interior Department halted its massive Revolution Wind project off the coast of Rhode Island.

Read more about Federal judge overturns Trump’s halt on Orsted’s offshore wind project

Plug Power’s stock is soaring and no one can figure out why

But even if there is no clear reason for Plug’s rally this month, Wall Street might be getting more bullish on PLUG stock fundamentals.

Read more about Plug Power’s stock is soaring and no one can figure out why

Nvidia continues flexing ‘AI dominance’ with $100B OpenAI deal

It turns out Nvidia’s (NVDA) $5 billion investment in Intel (INTC) was just a warm up for a much bigger bet on the AI ecosystem

Read more about Nvidia continues flexing ‘AI dominance’ with $100B OpenAI deal

UK government partners with Palantir on a potential $1.8B defense investment strategy

Palantir Technologies (PLTR) is diversifying its portfolio of government contracts beyond the US to partner with America’s allies

Read more about UK government partners with Palantir on a potential $1.8B defense investment strategy

“Dude, you’re outperforming Apple” — How Dell 2x’d Apple over the past five years

Once dismissed as a low-growth PC maker, Dell has reinvented itself as an AI infrastructure heavyweight, delivering a 306% return over five years

Read more about “Dude, you’re outperforming Apple” — How Dell 2x’d Apple over the past five years

Microsoft says it’s opening ‘world’s most powerful AI datacenter’

Microsoft (MSFT) claims that an AI datacenter it’s building in Wisconsin will be the most powerful facility in the world

Read more about Microsoft says it’s opening ‘world’s most powerful AI datacenter’