Stock Update

Trump’s FTC chief to Big Tech: Don’t bow to EU censorship rules

Federal Trade Commission Chairman Andrew Ferguson fired off a letter to 13 of America’s biggest tech companies, including Meta (META), Apple (AAPL), Alphabet (GOOG), Amazon (AMZN), and Microsoft (MSFT)

Read more about Trump’s FTC chief to Big Tech: Don’t bow to EU censorship rules

SoundHound's AI voice assistant hits Jeeps, analysts call it $35B revolution

SoundHound (SOUN) just notched another milestone in its partnership with Stellantis (STLA), announcing that its generative AI-powered voice assistant is now live in select Jeep vehicles

Read more about SoundHound's AI voice assistant hits Jeeps, analysts call it $35B revolution

Broadcom’s $1.4 trillion secret weapon in the AI arms race

Broadcom (AVGO) has long been considered a backbone of the AI boom, but analysts argue its importance has been “underappreciated” compared with the spotlight on Nvidia (NVDA).

Read more about Broadcom’s $1.4 trillion secret weapon in the AI arms race

Tesla's Europe nightmare has begun

Tesla (TSLA) sales continue to tumble in Europe, one of the world’s most EV-friendly regions with strict mandates and environmentally conscious consumers.

Read more about Tesla's Europe nightmare has begun

Cava's 'next Chipotle' dreams face a harsh reality check

Fast-casual chain Cava (CAVA) rose to prominence on hype that it could become the “Mediterranean Chipotle.” Those analogies have faded since

Read more about Cava's 'next Chipotle' dreams face a harsh reality check

D-Wave (QBTS) crowned quantum pioneer, but can it ever make money?

As one of the few pure-play quantum small caps, Canadian startup D-Wave (QBTS) has become a go-to speculative bet on the sector

Read more about D-Wave (QBTS) crowned quantum pioneer, but can it ever make money?

Wall Street's top analyst calls CrowdStrike ‘gold standard’ of cybersecurity

Wedbush analyst Dan Ives — one of the Street’s most influential tech voices — recently added CrowdStrike to his “IVES AI Revolution 30” list

Read more about Wall Street's top analyst calls CrowdStrike ‘gold standard’ of cybersecurity

Serve Robotics wins bullish call from one of Wall Street’s most influential analysts

Autonomous delivery startup Serve Robotics (SERV), which positions itself as “the future of self-driving delivery,” is starting to get Wall Street’s attention.

Read more about Serve Robotics wins bullish call from one of Wall Street’s most influential analysts

Wall Street bets on robot takeover with Serve Robotics (SERV) at the forefront

Autonomous delivery startup Serve Robotics (SERV), which brands itself as “the future of self-driving delivery,” may see that future arrive sooner than expected.

Read more about Wall Street bets on robot takeover with Serve Robotics (SERV) at the forefront

IBM and AMD plot quantum supercomputer that could kill Nvidia’s AI monopoly

IBM (IBM) announced this week that it is teaming up with AMD (AMD) to develop next-generation computing architectures

Read more about IBM and AMD plot quantum supercomputer that could kill Nvidia’s AI monopoly

“Narrow breadth”? No problem. Goldman Sachs bets big on another S&P 500 rally

Despite overvaluation risks and narrow market breadth, Goldman sees rate cuts and the Magnificent 7 driving the index to 6,900 within a year

Read more about “Narrow breadth”? No problem. Goldman Sachs bets big on another S&P 500 rally

Uber doubles revenue with flat headcount, but at what cost to drivers?

Uber’s revenues are soaring past $50 billion and its stock is up 60% in 2025, yet critics say the company’s gig workers are footing the bill as earnings lag under new pricing models

Read more about Uber doubles revenue with flat headcount, but at what cost to drivers?

SoundHound stock breaks out, but Taco Bell’s voice AI warning may be the canary in the coal mine

Taco Bell’s second thoughts on drive-thru AI highlight cracks in the fast-food adoption story for SOUN stock

Read more about SoundHound stock breaks out, but Taco Bell’s voice AI warning may be the canary in the coal mine

Federal investigation into UnitedHealth is much worse than previously thought

As it turns out, the DOJ criminal division’s scrutiny into the company’s corporate practices is not just limited to its handling of the Medicare program

Read more about Federal investigation into UnitedHealth is much worse than previously thought

Needham analyst: Rivian's affordable SUV could be a game-changer for RIVN stock

There's “strong RIVN brand awareness, limited negative perception and encouraging purchase intent, positioning RIVN favorably to capture share as the R2 enters the mid-size SUV segment.”

Read more about Needham analyst: Rivian's affordable SUV could be a game-changer for RIVN stock

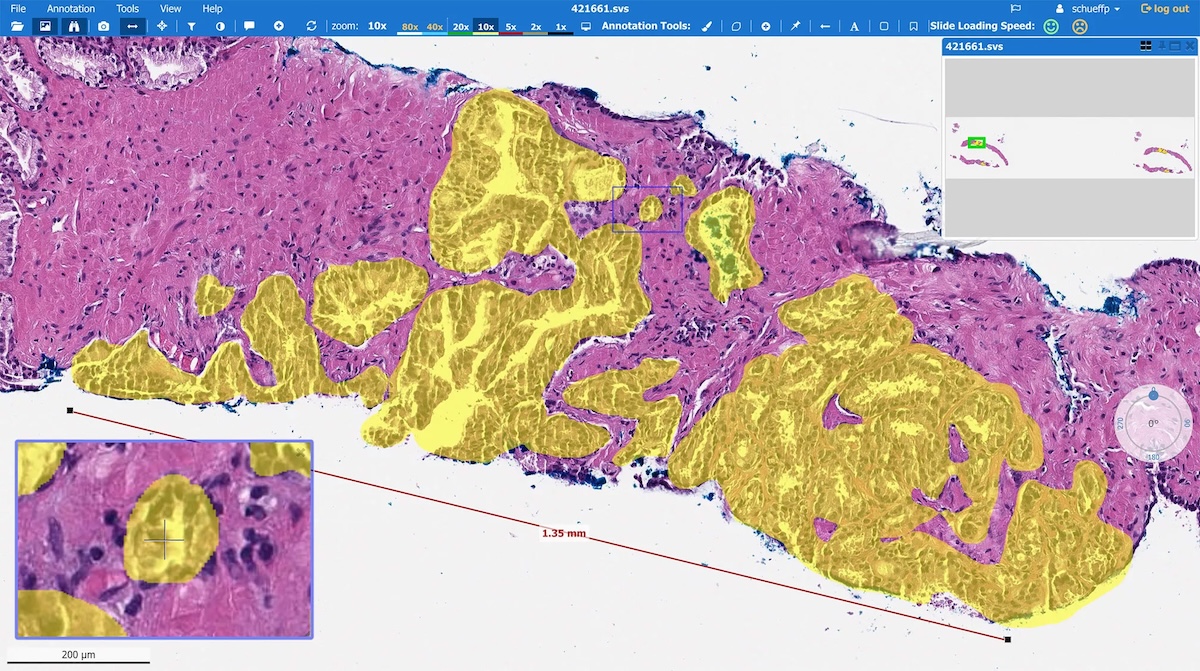

Smart exit or AI fire sale? Tempus AI buys Paige for $81M after raising $241M

Paige was founded in 2017 and deployed the first FDA-approved AI application in pathology, which allows researchers and pathologists to better detect cancer.

Read more about Smart exit or AI fire sale? Tempus AI buys Paige for $81M after raising $241M

GE Vernova’s (GEV) turbines, not chips, could be the real AI infrastructure play

GE Vernova (GEV) stock has quietly outpaced the AI rally with gas turbines and nuclear power, but questions about valuation risk are growing louder

Read more about GE Vernova’s (GEV) turbines, not chips, could be the real AI infrastructure play

Jensen Huang’s AI prediction is more bullish for NBIS stock than Nvidia

As Nvidia signals a $4 trillion AI infrastructure wave, Nebius is emerging as the stealth cloud player riding the inference boom — with growth that’s already eclipsing the chip giant.

Read more about Jensen Huang’s AI prediction is more bullish for NBIS stock than Nvidia