Earnings season is now underway. Many of the largest banks are releasing quarterly results this week. This time of the quarteris always big for investors to gauge how the overall economy is doing.

The importance of quarterly numbers is bolstered by the massive uncertainty brought about by the global pandemic. Many businesses have opened back up and quarantine has all but been lifted in most areas. We have never seen anything have this kind of effect on an economy in recent times and speculation continues about the path of the recovery. Earnings will give a detailed picture of how many of the worlds biggest companies are doing in the wake of COVID-19. The banking industry may provide the best insight into the overall health of the economy.

What are Banks Saying About the Economy?

There have been many discussions whether the economy will experience a V, U, L, or K-shaped recovery, and while the stock market has rebounded already, the unemployment rate and GDP will take much longer to get back on track. Millions of people are still without jobs and more than 800,000 people file new claims for unemployment each week. That number is down significantly from 6.8 million where it peaked in late March but is still a long way from 200,000, where it was before the coronavirus hit. The reality is that it will take a significant amount of time to get back to below 4% unemployment. Many sectors of the economy will be running at a limited capacity for the foreseeable future. While a vaccine will certainly help things recover faster, there is no way to guarantee that one will be discovered by the end of the year let alone distributed to billions of people around the world.

Banks set aside billions of dollars in the first quarter when the pandemic hit to cover bad loans. A massive wave of defaults was expected given the nature of the recession that put more than 24 million people out of work in the span of a couple of months.

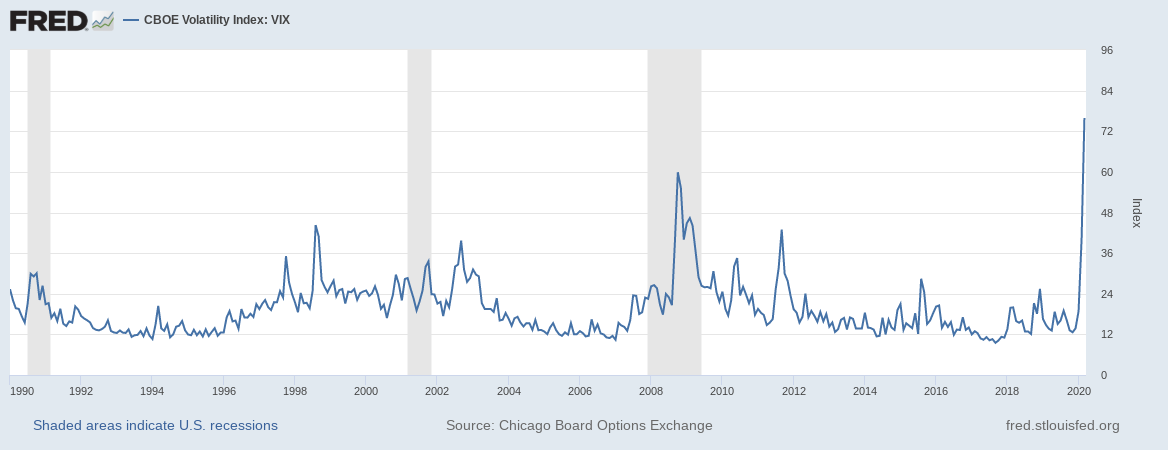

Quick stimulus packages passed by the government such as the CARES Act were able to help the economy and provide liquidity for borrowers and banks early on. Swift action from the Federal Reserve to lower interest rates and keep markets stable helped keep things stable during an extremely volatile time. This kept things from getting as bad as they could have so banks' early estimates of how bad things would get were likely worse than necessary.

What Will Earnings Look Like?

Although things are looking better now than they did three months ago, investors shouldn't expect banks' results to indicate a quick recovery. Instead, the largest banks quarterly results should be compared to both the previous quarter and the same quarter of 2019 to give an idea on how the economy is recovering from the shutdown and where things stand in relation to "normal". Investors should be ready for improved performance that is still below compared to where things were a year ago.

Bank stocks continue to lag behind most other industries due to investors remaining uncertain about what's to come for the broader economy. Wells Fargo (WFC), Bank of America (BAC), Citigroup (C), and JPMorgan Chase (JPM) have bulked-up reserves for defaulted loans and believe they have enough set aside for credit losses. However, JPMorgan and Citigroup both reported setting aside significantly less reserves than expected when they presented their quarterly reports Tuesday morning. Big contributions to reserves hurt the bottom line last quarter, but adding less to reserves this time around should help boost earnings for all four of the big banks. JPM and C both beat estimates EPS of $2.92 and and $1.40 respectively.

There still remain some key factors that will stifle growth from these businesses and could cause a collapse should things go really wrong. Firstly, interest rates remain extremely low and are naturally going reduce net interest income. Lastly, should defaults start to rise, it could mean banks need to start adding to reserves again, or even cause a repeat of the financial crisis.

The Long-Term Outlook for Big Banks

While banks are going through an extremely difficult time, the largest firms are likely to keep growing as national banks continue to dominate over their local competitors. Bank deposits swelled once the coronavirus hit as people deposited those stimulus checks. For bank earnings to really rebound, that increase in deposits needs to be matched by an increase in lending and other activity. Thus far, small businesses in particular, have been reluctant to borrow money to expand their business given the uncertain times many find themselves in.

Wrapping Up

Earnings season will provide insight into many different sectors of the economy. COVID-19 had a devastating effect on markets and the economy and its impact will be felt for some time. As a real-time measure of current economic activity, bank earnings will give a detailed view of how the economy is recovering from this pandemic. Let's hope this goes faster than it did 12 years ago.