You may have heard the term Modern Portfolio Theory (MPT) before and wondered what exactly it entails. Most of investing today relies on the beliefs and principles contained in Modern Portfolio Theory.

What is Modern Portfolio Theory?

The basis of MPT revolves around risk and the idea that higher returns come with higher levels of risk. The theory assumes that investors are risk-averse. If two portfolios typically offer a 7% annual return but one carries more risk with a wider range of potential outcomes, a portfolio manager will prefer the one that offers more stable and consistent returns.

Once the relationship between risk and reward is established, investors can build a portfolio with a target return or risk level. MPT focuses on optimizing the portfolio based upon the risk tolerance of the investor.

Efficient Frontier

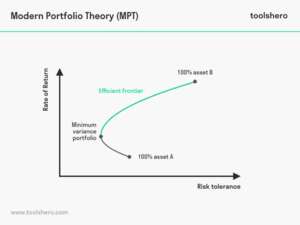

Modern Portfolio Theory describes an efficient frontier of portfolios that maximize returns based on a given level of risk. After deciding how much risk an investor wants to take on, they are able to choose from these optimized portfolios that offer the highest available growth rates.

Image by toolshero 2020

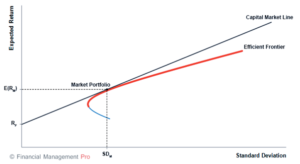

Using the efficient frontier combined with a risk-free asset such as short term Treasury bills, investors can move across the Capital Market Line (CML). This line consists of a spectrum from risk-free to very risky assets and allows investors to choose any desired level of risk and then get returns optimized to that level of risk. The CML allows portfolio managers to lend money in the form of Treasury bills which lowers their risk, and also allows for borrowing to increase risk with the goal of achieving higher expected returns.

Calculating Risk vs Return

The expected return of the entire portfolio is very simple to calculate as it is just the weighted sum of each individual assets expected return. For example, if a portfolio consists equally of Apple (AAPL) and Nike (NKE), the portfolio’s expected return would be the weighted-average of those two stocks' expected returns.

Expected Return (ER) = (% of AAPL in portfolio x ER of AAPL) + (% NKE in portfolio x ER of NKE)

The expected risk of the portfolio is more complicated. It consists of the percentage invested in each asset and each asset’s expected volatility, which the formula refers to as standard deviation. These calculations along with the correlation coefficient between all of the investments gives a portfolio’s overall risk. Essentially, because of asset correlations, the entire portfolio risk is lower than what would be calculated if using a simple weighted sum formula. A full description of the equation for portfolio risk can be found here.

The Significance of Modern Portfolio Theory

This is what makes MPT interesting and groundbreaking. When it was introduced, its view that individual investments should not be viewed by themselves but instead by how they impact the entire portfolio’s performance, was revolutionary. Essentially, using correlation and variance analysis, investors can construct portfolios that increase returns while still minimizing risk.

For example, a portfolio that consists entirely of stocks in the U.S. airline industry is going to be more risky than one that is allocated across multiple sectors and regions. This is because if a major event harms the airline industry such as a virus outbreak or travel halt, it will lead to huge losses in a portfolio that only has investments in airline companies.

The portfolio that is diversified across multiple sectors will still experience losses from companies affected by the virus or travel halt. The losses however may be offset by potential gains from other industries invested in or even just stocks holding their value while airlines fall.

How to Build a Modern Portfolio

Thus, the goal for a modern portfolio is to maximize the benefits of diversification by trying to invest in a wide variety of securities that are not correlated with each other.

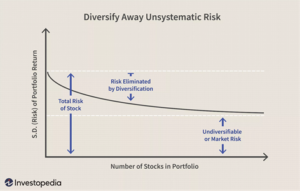

There are two main forms of risks according to Modern Portfolio Theory: Systemic and Unsystemic. Systemic risks are market risks such as recessions or changes in interest rates that cannot be avoided through diversification. Unsystemic risks pertain to individual stocks and the risk of a drop in sales or profit. These are the risks that can be diversified away as they represents the part of a stock’s return that is uncorrelated with market changes.

Image by Julie Bang © Investopedia 2020

Portfolio managers want to focus on unsystemic risk as it can be limited by investing in different stocks. If the entire market is down due to systemic risk, then a portfolio of stocks is going to fall in value most of the time regardless of its diversification. But having assets allocated in different regions and sectors limits the exposure to geographical and industrial risk.

A diverse portfolio even limits losses when in a recession and bearish stock markets. Walmart (WMT) and other discount stores typically see higher returns during hard times as people look to cut costs while searching for the best prices.

Gold also receives some of its value during economic troubles as it is not correlated with the majority of stocks and is used frequently as a hedge against inflation. Gold is actually one of the best examples of this because it does not typically offer very high returns but is still desirable amongst many investors due to it not trading in symmetry with the rest of the market.

Many investors have now started to use Index funds as an easy way to allocate assets across multiple firms and industries. Individuals also desire these index funds for their lower fees and a belief in efficient market hypothesis.

The Key Point of MPT

Modern Portfolio Theory really started the trend of diversifying assets in order to minimize risks. Plenty of portfolio managers already knew not to put all their eggs in one basket, but MPT is what gave a quantitative overview of why spreading assets across multiple markets minimizes risk while still achieving optimal growth.