Stocks marched higher to kick the New Year off right ahead of a busy week of economic reports, as well as a light week of earnings.

Omicron will continue to be a talking point this week after 10 million people tested positive in a single week. This is nearly double the pace of the previous weekly record, which is leading to increasing fears that the variant could disrupt economic activity.

While the severity of illness from Omicron continues to suggest that the variant is weaker than Delta and the initial strain, the rapid pace may dampen output by incapacitating workers or by forcing areas into lockdown.

FOMC Minutes

The minutes from the December policy-setting Federal Open Markets Committee meeting will be a highly tracked event this week. Investors will be looking for more context about the Fed's policy changes in December.

When the Fed increases the interest rate, banks are able to raise rates as well, boosting profits on money lent. For the largest banks, “even a small increase in the Fed’s benchmark rate could lead to billions of dollars in revenue.”

Jobs Report

Another big report on its way this week is the December jobs report.

Nonfarm payrolls are expected to have grown by 440,000 jobs in December following November’s rise of 210,000 jobs. Meanwhile, nonfarm private payrolls are expected to have added 420,000 jobs following the addition of 235,000 jobs in November.

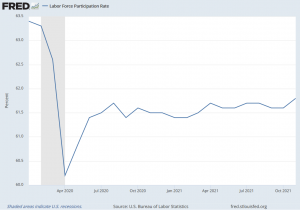

The labor force participation rate will be the most-watched part of the report, as, in November, there remained about 2.4 million people yet to return to the labor force compared to February 2020’s labor force. Given the ongoing labor shortage, we need that gap to shrink up in order to help supply chains and prices get back on track.

Bloomberg economists noted, “given how often households have cited fear of COVID or care-taking needs related to COVID as the most important reasons for staying out of the job market, the emergence of the Omicron variant could continue to discourage them.”

As shown in the graph above, the labor force participation rate has been slow to rebound and has struggled to maintain a direction for consecutive months. Some number of these employees may never return, as many of those with the option opted to retire.

This makes it all the more crucial that we get the caretakers and those out of the labor force due to covid fears back in the workforce because we're already trying to fill a growing number of jobs from a smaller pool.

But with Omicron spreading like wildfire, those who recently started working after, perhaps, getting a booster, might be on their way back out the door now that the holidays are in the past and they may not need the extra income.

Earnings

While earnings will remain light in respect to the number of reports offered, there will be some notable reports later this week. Walgreens Boots Alliance (WBA), Conagra (CAG), and Constellation Brands (STZ) all report before market open on Thursday.

Walgreens will have a particularly interesting report as the drugstore follows up on a very strong quarter. In the previous quarter, in which Walgreens surged after beating earnings and revenue estimates while providing upside full-year 2022 earnings guidance, Walgreens administered nearly twice the expected number of vaccinations.

Walgreens previously reported on Oct. 14, for the period ended Aug. 31. This could mean another strong quarter of vaccinations is on its way as the previous report missed revenues from the opening of the booster to all adults on Nov. 19 and the discovery and surge of the Omicron variant. Both of these happened near the end of the quarter (through Nov. 30), so watch out for bullish guidance and comments that suggest that the company is experiencing a pickup in vaccine and booster interest in the current quarter.

Economic Events this Week

Tuesday

- 10:00 ET - ISM Manufacturing Index

- 10:00 ET - JOLTS - Job Openings

Wednesday

- 07:00 ET - MBA Mortgage Applications Index

- 08:15 ET - ADP Employment Change

- 09:45 ET - IHS Markit Services PMI - Prelim

- 10:30 ET - EIA Crude Oil Inventories

- 14:00 ET - FOMC Minutes

Thursday

- 08:30 ET - Continuing Claims

- 08:30 ET - Initial Claims

- 10:00 ET - Factory Orders

- 10:00 ET - ISM Non-Manufacturing Index

- 10:30 ET - EIA Natural Gas Inventories

Friday

- 08:30 ET - Average Workweek

- 08:30 ET - Avg. Hourly Earnings

- 08:30 ET - Nonfarm Payrolls

- 08:30 ET - Nonfarm Private Payrolls

- 08:30 ET - Unemployment Rate

Earnings Reports This Week

Tuesday:

After the bell:

JEF, MLKN, SGH

Wednesday:

Before the bell:

RPM, SMPL

After the bell:

RGP

Thursday:

Before the bell:

WBA, CAG, STZ, BBBY, SAFM, LW, SCHN, HELE, LNN

After the bell:

EDU, PSMT, WDFC, DCT

Friday:

Before the bell:

AYI, GBX